44+ how much should mortgage be based on income

Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income. Web Based on your DTI and depending on your other debts you could be approved for a mortgage of 600000.

Mortgage Banker Vs Broker Top 8 Difference To Learn With Infographics

Ad 10 Best Home Loan Lenders Compared Reviewed.

. To calculate how much you can afford with the. This is also known as the. A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly income.

Web When determining what percentage of income should go to mortgage a mortgage broker will typically follow the 2836 RuleThe Rule states that a household should not spend. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly. With a Low Down Payment Option You Could Buy Your Own Home.

Web Based on the 28 percent and 36 percent models heres a budgeting example assuming the borrower has a monthly income of 5000. Ad Tired of Renting. With a 30-year mortgage your monthly income should be at least 8200 and your monthly.

Enter details about your income down payment and monthly debts. Ad Tired of Renting. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Veterans Use This Powerful VA Loan Benefit for Your Next Home. Check Your Official Eligibility Today. 43 043 x 5000 2150 Max debt payments.

1000 Max home expenses. The answer is 28 of your monthly income. Web How much mortgage can you afford.

However how much you. Web Use Zillows affordability calculator to estimate a comfortable mortgage amount based on your current budget. Comparisons Trusted by 55000000.

Ad Take the First Step Towards Your Dream Home See If You Qualify. Compare More Than Just Rates. Web To afford a 400000 house borrowers need 55600 in cash to put 10 percent down.

Updated FHA Loan Requirements for 2023. Find A Lender That Offers Great Service. Lets say you earn 5000 after taxes.

Save Time Money. With a Low Down Payment Option You Could Buy Your Own Home. Web What percentage of income do I need for a mortgage.

Get Instantly Matched With Your Ideal Mortgage Lender. With a Low Down Payment Option You Could Buy Your Own Home. Web Now you know you can only afford a new home if the total monthly payment comes out to 1150 or less.

Web How Much Of My Monthly Income Should I Spend On A Mortgage. With a Low Down Payment Option You Could Buy Your Own Home. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Remember to include property taxes homeowners. Fidelity Investments Can Help You Untangle The Process. Web According to this rule your mortgage payment shouldnt be more than 28 of your monthly pre-tax income and 36 of your total debt.

That might sound exciting at first but with a. Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment. The median income in the US.

5000 x 028 28 1400. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Lock Your Rate Today. Why Rent When You Could Own. If this were your.

Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Get Instantly Matched With Your Ideal Mortgage Loan Lender. Why Rent When You Could Own.

Ad Buying A Home Can Be Complex. Web This model states your total monthly debt should be 25 or less of your post-tax income. Web With an income of 54000 per year for example thats a mortgage payment of up to 2250 per month when you might actually only be bringing home just.

Ad Calculate Your Payment with 0 Down.

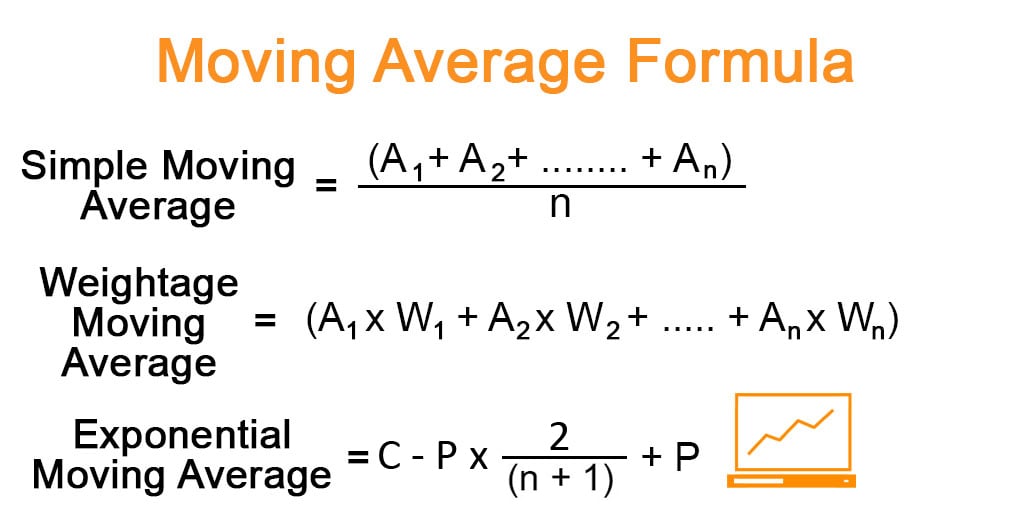

Moving Average Formula Calculator Examples With Excel Template

Income Statement Complete Guide On Income Statement

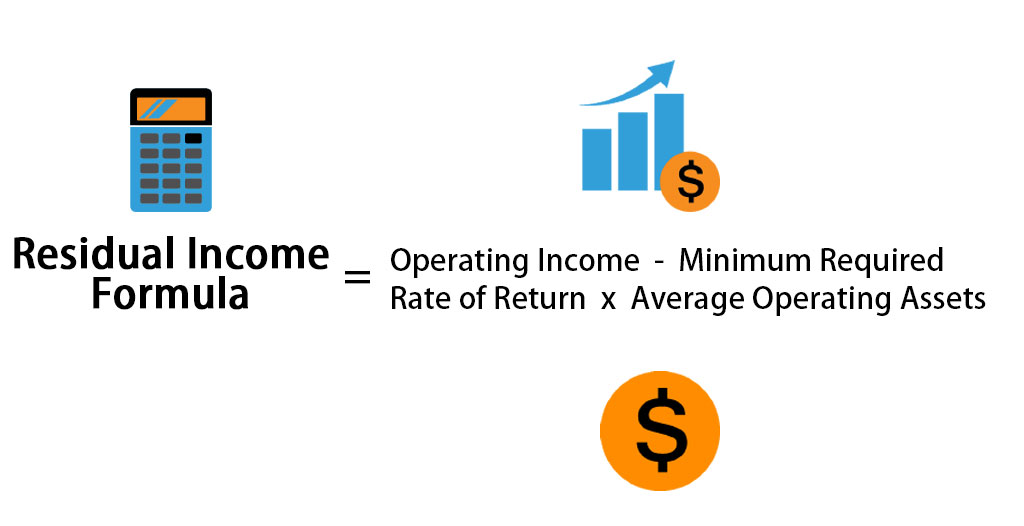

Residual Income Formula Calculator Examples With Excel Template

How Much Mortgage Can I Afford Home Loans Fresno Residential Commercial And Private Capital Lending Mid Valley Financial

Loan To Value Ratio Example Explanation With Excel Template

Free 6 Payment Calculator Mortgage Samples In Pdf Excel

Non Conforming Loan Complete Guide On Non Conforming Loan

National Income Formula Calculator Examples With Excel Template

First Community Mortgage Startseite Facebook

Percentage Of Income For Mortgage Rocket Mortgage

Loan Vs Mortgage Top 7 Best Differences With Infographics

Mortgage Fraud Complete Guide On Mortgage Fraud

Salary Formula Calculate Salary Calculator Excel Template

Income To Mortgage Ratio What Should Yours Be Moneyunder30

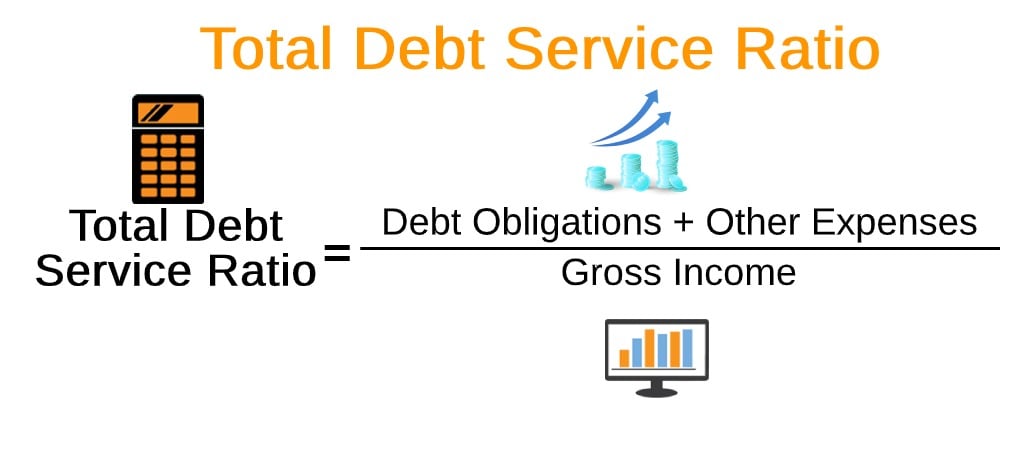

Total Debt Service Ratio Explanation And Examples With Excel Template

How Much Of My Income Should Go Towards A Mortgage Payment

First Community Mortgage Startseite Facebook